The initial idea of Blockchain was introduced in 1992, but only until 2008 the first real blockchain application on “Bitcoin” was conceptualized by a person (or group of people) known as Satoshi Nakamoto. Since then Bitcoin and other spinoff cryptocurrencies have been a hot topic. In recent years, people start to look for applying blockchain in different business sectors, and one key sector is Supply Chain.

Table of Contents

Blockchain Technology

Fundamentally, Blockchain is a distributed ledger network, which can be explained by two symbols in its name. A “Block” is just a ledger of all transactions that occurred across a certain internet protocol in some duration of time. Each block is signed with a cryptographic signature called hash value.

A cryptographic puzzle (aka. hash puzzle) needs to be solved in order to take any action on a block, this is often called “mining the block”. The “Chain” part of the Blockchain is by using the hash value of each block to chain itself to the past block that has been mined. Since each block has a hash puzzle and linked with each other, it is almost impossible to change transaction data on blockchain. To improve the security even further, blockchain introduced a mechanism called “consensus”, which means each ledger is broadcasted to each computer node in the network, for any change of that ledger, there must be 51% of all computer nodes agrees with such change. This prevents fraud or double spending without requiring a central authority.

The diagram below shows a 6-step view of how a Blockchain works.

Blockchain Constraints

The core features of a Blockchain are decentralization, cryptographic security, transparency, and immutability. To achieve security and transparency, a blockchain has to compromise “Privacy” and “Scalability” in return. Blockchain due to all the security mechanisms handles merely 3-20 transactions per second. For blockchain to go mainstream, it would need to process hundreds of thousands of transactions per second. Consensus mechanism requires ledger to be broadcast to each node in the network, all the information about that ledger will be transparent in the network to be validated. To overcome these two constraints, there were various spinoff blockchain platforms developed in recent years trying to solve the problem, however, so far, no platform had proven to have reached the perfect balance between security and scalability. Recent vote-buying scandal on EOS platform had highlighted the underlying security issue on a high scalable blockchain. On top of all the technical constraints, lack of regulatory oversight also makes the blockchain based cryptocurrency a very volatile commodity, scams and market manipulation are commonplace. All the constraints had prevented mainstream business in adopting blockchain technology.

Public vs. Permissioned

The blockchain mentioned above applies for public platform. There is also a permissioned version of blockchain. The word permission means only authorized parties can view and edit data on such network. With the limited access rights, number of computing nodes also dropped drastically, hence consensus mechanism requires much less of computing power. From going private, both privacy and scalability problem got solved. However, permissioned blockchain has to give up decentralization as a technical compromise. The business sector, unlike bitcoin type of public applications, requires high scalability and privacy, low on decentralization. Thus, permission blockchain will most likely be adopted by business sector in short term.

| Public | Permissioned |

| Open, anyone can join the network | Restricted and permissioned, a new member joins the network via invitation |

| Each Node has equal transmission power (Distributed) | Only certain nodes can create new transactions |

| Low speed of transaction accomplishment | Fast speed of transaction accomplishment |

| Long transaction approval frequency | Short transaction approval frequency |

| High cost of each transaction | Comparative cheap cost of each transaction |

| Proof-of-work, Proof-of-stake consensus for the adding on a new block | Pre-approved participants adding of a new block |

| Anonymous | Anonymous |

| Require no trust among the members | Members need to trust each other |

| Large energy consumption | Low energy consumption |

Diagram taken from: https://ambisafe.com/blog/public-vs-private-blockchain/

Strategic Approach for Adoption

Private, permissioned blockchain allows businesses both large and small to start extracting commercial value from blockchain implementations. The structured approach for implementing blockchain could be the following:

(1) Focus on Specific, Promising Use Cases

Identify specific pain points with a granular analysis of the potential commercial value of the permission blockchain solution. Companies need to understand the nuances of all these components to decide which use case will generate a solid return on investment. If a use case does not meet a minimum level of feasibility and potential return, then companies do not even have to consider the second step of which blockchain strategy to adopt.

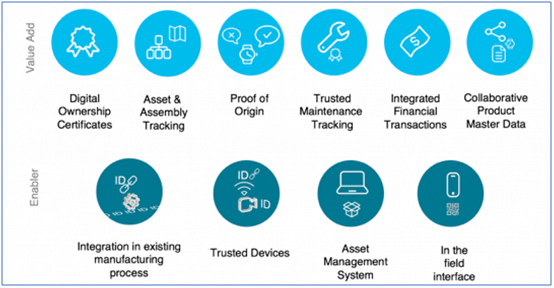

A very short-term focus for supply chain industry when applying blockchain should cost reduction. One of the key features of blockchain is clear ownership on chained blocks of data, companies adopting blockchain technology can quickly improve its visibility, traceability, and ultimately full transparency of supply chain with much less cost than traditional EDI based method. A brief blockchain solution overview can be seen in the diagram below:

(2) Optimize Blockchain Strategy based on Market Position

Once companies have identified promising use cases, they must develop their strategies based on consideration of their market positions relative to their target use cases.

o Market dominance: the ability of a player to influence the key parties of a use case

o Standardization and regulatory barriers: the requirement for regulatory approvals or coordination on standards

As supply chain industry relies heavily on standardization, the most beneficial strategy should be “coopetition” rather than “competition”. For companies with market dominance, for example, Amazon, Walmart, FedEx, DHL, UPS, etc. they should cooperate together to set the market standard. While for other smaller players, it is most cost-effective to follow the standard set by the industry.

Key Solutions Providers

The key players for supply chain blockchain solutions, according to HTF’s ‘Global Blockchain Supply Chain Market Report 2018, are the ‘big 5 beasts’: Amazon AWS, IBM, Microsoft Azure, Oracle, SAP and other vendors: TIBCO Software, Datex, Omnichain, OpenXcell.

The full content is only visible to SIPMM members

Already a member? Please Login to continue reading.

References

Andrew Tan Howe. ADLSM. (2018). “Impact of Blockchain on Fast Moving Consumer Goods”. Retrieved from SIPMM: https://publication.sipmm.edu.sg/impact-blockchain-fast-moving-consumer-goods/, accessed 17/12/2018.

Bernard Marr. (2018). “The 5 Big Problems With Blockchain Everyone Should Be Aware of”. Retrieved from: https://www.forbes.com/sites/bernardmarr/2018/02/19/the-5-big-problems-with-blockchain-everyone-should-be-aware-of/#14c5d8d51670, accessed 14/12/2018.

Brant Carson, et al. (2018). “Blockchain beyond the hype: What is the strategic business value”.Retrieved from: https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/blockchain-beyond-the-hype-what-is-the-strategic-business-value, accessed 14/12/2018.

Lucas Mearian. (2018). “SAP pilots blockchain-based supply chain tracker”. Retrieved from: https://www.computerworld.com/article/3298578/blockchain/sap-pilots-blockchain-based-supply-chain-tracker.html, accessed 15/12/2018.

Noelle Acheson. (2017). “IBM vs. Microsoft: Two Tech Giants, Two Blockchain Visions”.Retrieved from: https://www.coindesk.com/ibm-vs-microsoft-two-tech-giants-two-blockchain-visions, accessed 15/12/2018.

Srinivasan Varadarajulu,ADPSM. (2018). “Blockchain Technology Enabling Seamless Supply Chain” Retrieved from SIPMM: https://publication.sipmm.edu.sg/blockchain-technology-enabling-seamless-supply-chain/, accessed 17/12/2018.