“More Bang (Bank) for the buck”; “Do more with less”. This is what most organizations, especially CPOs in banks, are talking about when they think of procurement. But with budgets growing more slowly, and expectations of cost and efficiency savings growing faster than ever, how can organizations meet deliver expectations?

With today’s technology and maturity of the digital era, digital procurement solutions are allowing for more physical and digital inputs to be connected. This will bring about efficiency and eventually drive down cost. Fundamentally, digital procurement has become a must-have for effective and sustainable procurement.

Table of Contents

Application of Procurement Technology for Banks

A true digital procurement organization will ride the digital wave by moving beyond replicating the same tedious processes with new software. It will change the procurement landscape by automating transactional procurement, strategic sourcing to become predictive. This article discusses conventional digital technology and new-age digital technology identified to future-proof procurement processes in the banking sector.

Conventional Digital Procurement – Procure to Pay (P2P)

Today, most organizations would have deployed forms of core procurement technologies. These platforms usually include a combination of eSourcing, eProcurement (eCatalogs, eInvoicing, ePayment), amongst others. The solutions are procurement mainstays for many organizations and will remain relevant for the foreseeable future. These systems are typically characterized as deployments that require capital investment and significant system integration work. One such conventional digitalization of procurement would be the Procure-to-Pay process (P2P). It is the coordinated and integrated action taken to fulfill a requirement for goods or services in a timely manner at a reasonable price. The following describes the sequential steps and characteristics of P2P:

Requisition order placed

The system must allow electronic purchase requisitions. The functionality must be accessible to all individuals authorized to make requisitions.

Vendor Selection

The system has an electronic catalog of goods and services for selection. Alternatively, based on requisition order, the system may suggest potential vendor and issues a request for quotation (RFQ) outlining the requirements. Suppliers can respond with a bid on the job, detailing turnaround time, price, and pertinent material specifications. During the process of choosing suppliers, negotiations take place offline.

E- Purchase order (PO) issued.

The system contains workflow capabilities to set up automatic approval routing by goods, services, dollar value. Once the requisition order is approved, an electronic purchase order with amounts and delivery requirements is issued using procurement software through devices. The PO is sent to the appropriate vendor for fulfillment.

E- Receipts

The system will automatically generate a goods receipt note upon delivery completed. To enable this function, the system needs to integrate with asset tags or barcode to allow for automatic recognition of delivered goods.

E-invoicing

The system to accept and process electronic invoices. For suppliers who do not have a system that automatically generates an electronic invoice, there’s an online creation through a supplier portal or document scanning.

Automatic Invoice reconciliation.

The system automatically uses a three-way matching process comparing the purchase order and receiving a document with the invoice to confirm that the goods were delivered as ordered and billed accordingly. Line items that do not match are flagged and reported for investigation.

Accounts payable.

Payment options of purchasing cards, electronics funds, electronic cheque and automatic cheque printing.

In contrast to the above, there are technology for today’s maturing and emerging solutions that tend to be much quicker to deploy. Many use Software as a Service (SaaS) models, do not need significant preparation of data or systems, require no or light integration, and can produce results within days or weeks.

New-Age Digital Procurement – IoT Analytics

In most indirect procurement, teams are unable to capture and analyze data about suppliers, price, market because of numerous categories under which spend data needs to be classified and the lack of transparency on the data used to process purchases and to support the approval process. This is when IoT (Internet-of-Things) analytics comes in.

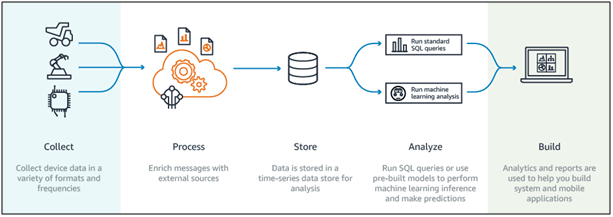

IoT analytics relies on collecting data to uncover actionable insight. It is an application of data analysis tools and procedures to realize value from the huge volumes of data generated by the connected Internet of Things devices but are only a subset of Big data. What IoT does is reach out far and wide for information within the data lakes in the organization, as follows;

• Collect data

• The process by enriching the data

• Store and analyze processed data

• Build a dashboard.

This can empower organizations to have the visibility for spend analysis and keep a vigilant eye on end-users’ consumption pattern.

Further to that, organizations can capture data from external sources, relevant to procurement and sourcing, e.g. data outside the organization, such as category market intelligence, which is arguably even more important. By putting deep and rich data at the fingertips of stakeholders, it supports fast and informed decisions and if it is the right item to buy and from whom.

Finance Technology (Fintech)

If data is the fuel, technology is its engine that will harness and make sense of the data. Banks turn towards Fintech where solutions are efficient and effective at lower scale and cost. Fintech can provide integrated platforms that not only incorporate purchasing management and accounts payable functions; they can also connect organizations with its network of service providers that are pre-vetted. This enables stakeholders to research on the project within a shorter timeframe, vet suppliers for their requirement, perform “smart-sourcing” on the integrated platform, receive e-contracts, e-invoices and trigger for payment once goods and services are received in order without the need for human interaction.

It becomes an ecosystem that holds the relationship together across back-end teams like finance, procurement, operations with the aim to “force” the silo-ed teams to the interface (their data) to service stakeholders.

One such Fintech for procurement is Globality, where they provide Sourcing capabilities, by matching leading companies with top small and midsize service firms around the world using A.I technology. HSBC engaged Globality, aiming to cut costs, accelerate decision-making and get access to the best suppliers by adopting Globality’s artificial intelligence (AI)-driven self-serve procurement platform.

Big data and Machine-learning

Big Data is actually a “Big Opportunity for Procurement”. Big data cannot be wangled in an old-fashioned way. This is when machine learning comes in. When big data and machine-learning join forces, predictive procurement becomes one of the game-changer to the procurement world.

This is where machines use the previous spend and purchasing patterns, existing catalog, supplier rating, perform analysis that predicts the procurement for business.

For example, the IT team may only have the requirement to purchase a server. Based on the data, machines can have the ability to forecast or remind the IT team to also purchase peripherals such as RAMs and Switchnets and M.R.O, that will make the procurement complete. This provides stakeholders with the ability to forecast on what is necessary and even help with budget forecast.

The full content is only visible to SIPMM members

Already a member? Please Login to continue reading.

References

Accenture LLP. (2018). “Next-generation digital procurement”. Retrieved from https://www.accenture.com/no-en/insight-digital-procurement-process, accessed 22/06/2019.

Brian Umbenhauer (2019). “Digital supply networks strengthen procurement strategy”. Retrieved from https://www2.deloitte.com/us/en/pages/operations/articles/digital-supply-networks-procurement-digitalization-strategy.html, accessed 22/06/2019.

Hubbis. (2019). “HSBC chooses Globality AI-driven procurement system to boost client services”. Retrieved from https://hubbis.com/news/hsbc-chooses-globality-ai-driven-procurement-system-to-boost-client-services, accessed 23/06/2019.

Kristin Ruehle (2019). “Own the supplier relationship before it owns you”, Retrieved from https://www.accenture.com/us-en/blogs/blogs-kristin-ruehle-supplier-management-capability, accessed 22/06/2019.

Michelle Lee Ean Wei, ADPSM. (2019). “New Technologies that will Impact Future Supply Chains”. Retrieved from SIPMM: https://publication.sipmm.edu.sg/new-technologies-impact-future-supply-chains, accessed 22/06/2019.

Newgenapps. (2019). “5 imperative Deep Learning trends in 2019”. Retrieved from https://www.newgenapps.com/blog/5-imperative-deep-learning-trends-in-2019, accessed on 25/06/2019.

Nillian Low, ADPSM. (2019). “Integrating AI with IoT for an Effective Supply Chain”. Retrieved from SIPMM: https://publication.sipmm.edu.sg/integrating-ai-iot-effective-supply-chain, accessed on 25/06/2019.

Procurement Leaders. (2019). “The challenges and opportunities of digitization”. Retrieved from https://www.procurementleaders.com/procurement-resource-library/resources-articles/the-challenges-and-opportunities-of-digitisation-#.XQ3KAPZuKHs, accessed 22/06/2019.

Vroozi. (2015). “What to Do with Purchasing Information Provided by the Internet of Things”. Retrieved from http://spendmatters.com/2015/08/06/what-to-do-with-purchasing-information-provided-by-the-internet-of-things/, accessed on 23/06/2019.

Zycus. (2018). “Understanding Indirect procurement-How indirect and Direct purchasing are different and their impact on your business bottom-line”. Retrieved from https://www.zycus.com/blog/indirect-procurement/understanding-indirect-procurement.html, accessed 23/06/2019.