The 19th century was a period of great change and rapid industrialization. The iron and steel industry spawned new construction materials, the railroads connected the country and the discovery of oil provided a new source of fuel. The discovery of the Spindle top geyser in 1901 drove huge growth in the oil industry. Within a year, more than 1,500 oil companies had been chartered, and oil became the dominant fuel of the 20th century and an integral part of the American economy.

While the United States was blessed with plentiful supplies of oil its growth to the rank of a great power accelerated. In today’s world as an oil-dependent power it must find alternate sources of energy or accommodate drastic changes in its way of life and position in the world.

Table of Contents

Oil and Gas Industry 4.0

The oil and gas industry has experienced turbulent times in the last two years, and companies in the sector have made massive efforts to curb costs and scale back on new project development.

Based on the uncertainties about the direction of industry, there has been much speculation about the continuity of petroleum as the main source of energy in modern civilisation, and about the permanence of low oil prices for an extended period.

Analyses of the usual practices in the oil and gas industry suggest that the sector is undergoing digital disruption and a technological re-organisation of its methods and industrial processes, in-line with a global technological trend that German business has coined as “Industry 4.0” or the “fourth industrial revolution”.

Need for Improved Supplier Performance

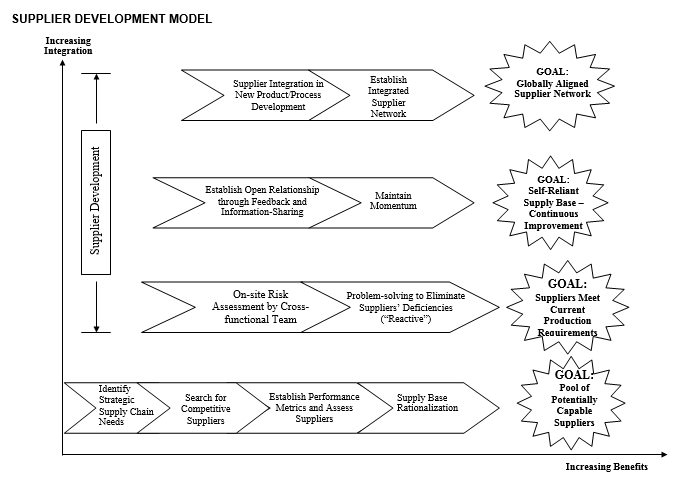

Before purchasing organizations become involved in supplier development, other supply base management practices such as supplier evaluation and supply base rationalization should already have been deployed.

The need for improved supplier performance should be explicitly identified and aligned with end-customer requirements and new product development targets. Such needs are driven by customers’ product-specific demands in areas such as cost, quality, delivery, technology and similar objectives, and broader needs in the areas of competitive priorities, global competition, and supply base deficiencies.

Searching for Competitive Suppliers

This stage involves a worldwide search for competitive suppliers based on the criteria established. Once a targeted global region is identified, a focused search in the region of interest is carried out. This targeted search is often facilitated and carried out in conjunction with local government agencies and/or partners within the region.

Establishing Performance Metrics and Assessing Suppliers

Companies typically established a performance measurement system to assess and track suppliers’ performance over an extended period. Ideally, this performance measurement system should be real-time, and provide immediate feedback to the supplier.

Supply Base Rationalization

As a function of the search and assessment, suppliers that are clearly not capable of meeting the company’s needs are eliminated and the supply base is optimized. The outcome of this strategy is a pool of suppliers that are potentially capable of meeting the purchasing organization’s need for products and services.

On-site Risk Assessment by Cross-functional Team

Once a pool of suppliers has been identified, performance metrics are established in the following areas: cost, quality, delivery, cycle time, product and process technology, engineering capabilities and management skills. A detailed risk assessment of suppliers by a cross-functional team of specialists is performed. This team should spend several days with each supplier, and should note suppliers’ deficiencies, weaknesses as well as their strengths.

The full content is only visible to SIPMM members

Already a member? Please Login to continue reading.

References:

Basilio, L. (2017). “Industry 4.0 and What It means for Oil and Gas”. Retrieved from https://www.oilandgasiq.com, accessed 31/08/2017.

Handfield, R. (2017). “Supply Chain Resource Consortium”. Retrieved from https://scm.ncsu.edu, accessed 31/08/2017.

Wall, H. (2017). Retrieved from http://www.history.com/topics/oil-industry, accessed 31/08/2017.