Oil and gas companies operate in dynamic and complex environments where they face constant challenges, especially in terms of supply and demand. Now, with oil prices at historic lows, procurement plays an important role within the spectrum of humongous oil and gas industry.

Procurement spending is among one of the significant portions of overall spending on an oil and gas project. Since selection of a superior or mediocre supplier can make or break an oil and gas project, it is critically important to select a superior and high-quality supplier that can supply equipment and/or services that are cost effective, comply with the specified requirements and do not risk schedule. The photograph below shown the equipment in the oil rig.

Table of Contents

5 Supplier Evaluation Methods

There are number of approaches being used to assist the supplier performance evaluation. The following five effective evaluation methods are commonly used today in the oil and gas industry.

1. Categorical Method

Categorical method is the most uncomplicated method. The lists of relevant performance variables or factors are defined. The buyers will assign performance ratings of each evaluating attribute in categorical terms, e.g. “good”, “neutral”, and “poor”. The ratings are judged by agreement between various representatives from several functions in the company such as procurement, logistics and production. The supplier who obtains highest score will then be the best performer.

2. Weighted-Point Method

Weighted-point method is the most frequently used method for evaluation process. With weighted-pointed method, different attributes which are important to the customers are weighted as per their importance level. The evaluator assigns the score to each supplier performance in each attribute and then the score will be multiplied by the assigned weight of each factor. Finally, the weighted score will be totaled to find out the final performance rating of each supplier. The supplier who obtains highest score will then be the best performer.

3. Cost Ratio Method

With cost ratio approach, the total cost of each purchase including selling price with the buyer’s internal operating costs, which are connected with the quality, delivery, and service components of the purchase, is calculated as the total company’s purchasing price. Each internal operating cost will be converted to a cost ratio which expresses the percentage of the total value of the purchase. Lastly, the overall cost ratio is applied to the supplier’s quoted unit price to obtain the net adjusted cost. The supplier with the lowest net adjusted cost would be the best preferred supplier.

4. Dimensional Analysis Method

Dimensional analysis model is a supplier evaluation technique with the purpose to resolve some of the drawbacks of the other approaches. The model combines several criteria of different dimensions and relative importance into a single entity for each supplier. Then the supplier performance index is calculated based on the supplier performance against the standard performance for a set of criteria and the relative importance of the criteria. Each supplier is evaluated according to the performance index created in this way. Criteria may have either positive of negative weight. For example, quality represents positive weight criterion while price represents negative weight criterion. In conclusion, the dimensional analysis model is used to measure each supplier against a standard set of criteria.

5. Analytical Hierarchy Process (AHP)

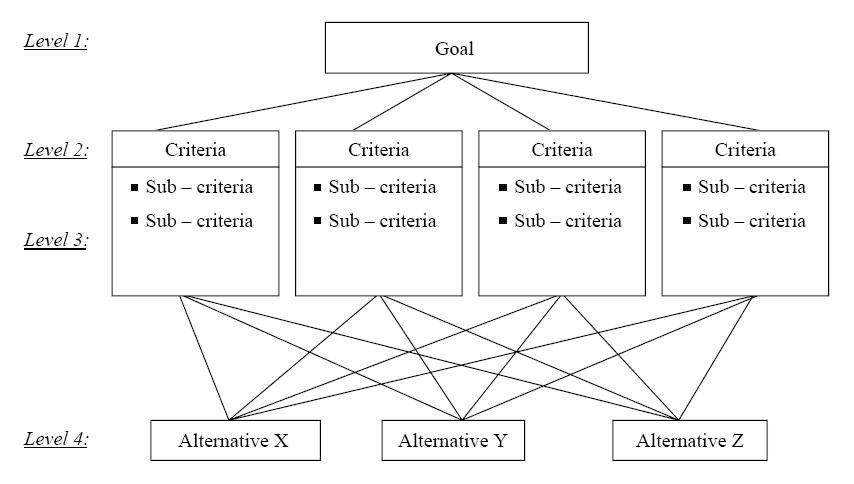

AHP can be considered as a problem-solving tool with flexibility and systemization to signify the elements of a complicate problem. The AHP is designed to break down a complicate, multiple criteria problem into levels of hierarchy with the top level as the objective, the intermediate levels as the criteria and sub-criteria, with the lowest level as alternatives. Figure 1 illustrates the general structure of AHP. The relative importance of each criterion determining which criterion has the highest priority. Interviews with the experts will be conducted to obtain pair-wise comparison for paired of homogenous criteria. With a series of pair-wise comparisons of all criteria, the weights of the criteria are determined and can be used to construct a supplier evaluation system.

Supplier Selection Process

Experts agree that no best way exists to evaluate and select suppliers, and thus organizations use a variety of approaches. The overall objective of supplier evaluation and selection process is to reduce risk and maximize overall value to the purchaser.

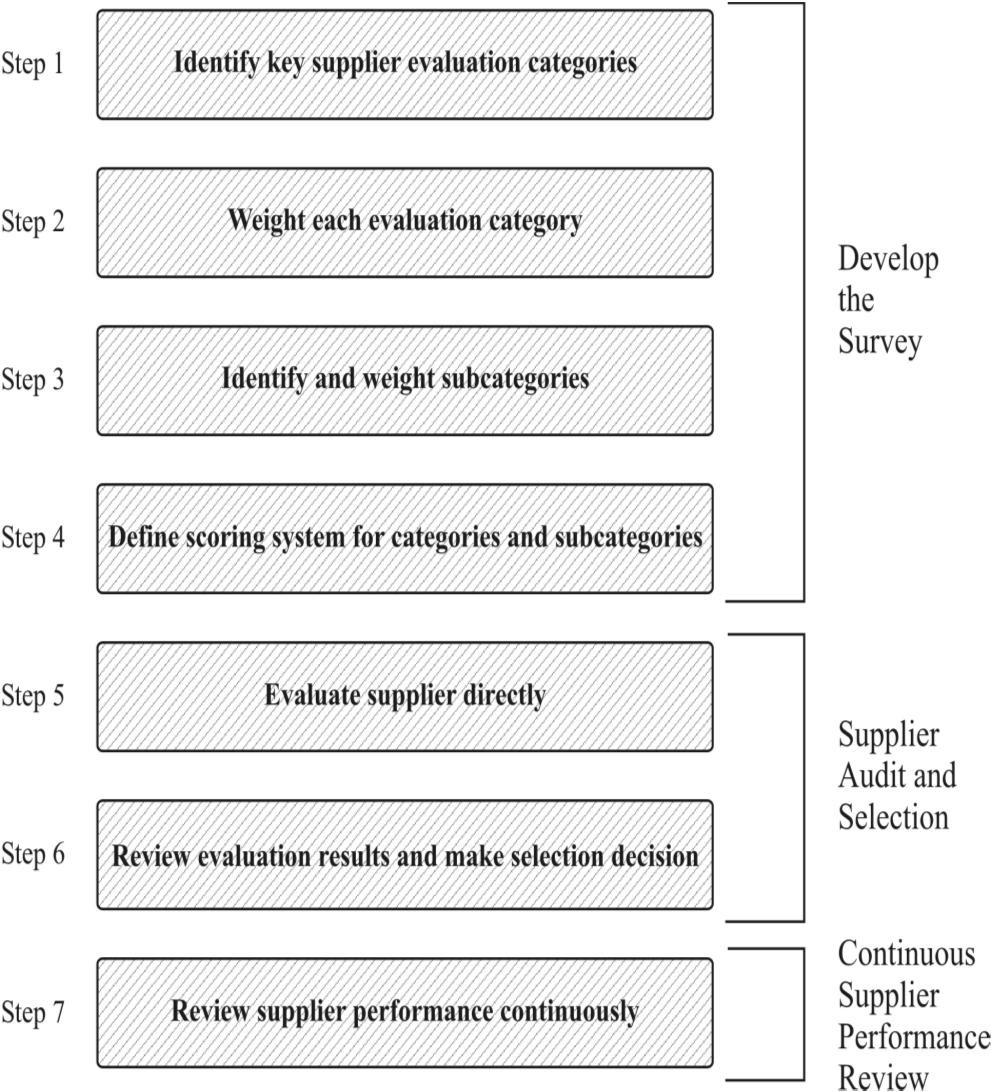

The supplier selection process is probably one of the most important tasks that a business will undertake. It can be a very complicated and emotional undertaking if the purchaser does not know how to approach it from the very start. The steps of supplier selection process is explained as follows.

Step 1: Identify key supplier evaluation categories

One of the first steps when developing a supplier survey is to decide which performance categories to include. The primary criteria are cost/price, quality and delivery, however for critical items needing an in-depth analysis of the supplier’s capabilities, a more detailed supplier evaluation study is required.

Step 2: Weight each evaluation category

The performance categories usually receive a weight that reflects the relative importance of the category. The total of each weight must equal 1.0. An important characteristic of an effective evaluation is flexibility. One way that management achieves this flexibility is by assigning different weights or adding or deleting performance categories as required.

Step 3: Identify and weight subcategories

This process requires identifying any performance subcategories, if they exist, within each broader performance category. The sum of the subcategory weight must equal the total weight of the performance category.

Step 4: Define scoring system for categories and subcategories

A clearly defined scoring system takes criteria that may be highly subjective and develops a quantitative scale for measurement. Scoring metrics are effective if different individuals interpret and score the same performance categories under review.

Step 5: Evaluate supplier directly

A purchaser can compare objectively the scores of different suppliers competing for the same purchase contract or select one supplier over another based on the evaluation score. Purchasers should have minimum acceptable performance requirements that suppliers must satisfy before they can become part of the supply base.

Step 6: Review evaluation results and make selection decision

The primary output from this step is a recommendation about whether to accept a supplier for a business. A purchaser may evaluate several suppliers who might be competing for a purchaser contract. The purpose of the evaluation is to qualify potential suppliers for current or expected future purchase contracts.

Step 7: Review supplier performance continuously

When a purchaser decides to select a supplier, the supplier must then perform according to the purchaser’s requirements. The emphasis shirts from the initial evaluation and selection of suppliers to evidence of continuous improvement by suppliers.

Conclusion

Since a good portion of overall procurement and supply chain cost is paid to the suppliers on any oil and gas project, supplier selection and evaluation is crucial in supply chain management in today’s global environment. There are several methods available to be applied for supplier evaluation methods. However, each method has different strengths and limitations. Therefore, no single method can address and solve all the concerned issues a company might have. The selection of supplier performance evaluation method depends on the nature of company and its product. By performing comprehensive in the supplier selection and evaluation, companies can also identify risks involved early in the project and implement necessary mitigation actions to ensure projects are executed effectively and efficiently.

References:

Cormican, K., & Cunningham, M. (2007). Supplier performance evaluation: lessons from a large multinational organization. Journal of Manufacturing Technology Management, 18(4), 352-366.

Vishal V.C. (2014). Supplier selection in supply chain management. International Journal for Research in Applied Science and Engineering Technology.

Ohdar, R., & Ray, P. K. (2004). Performance measurement and evaluation of suppliers in supply chain: an evolutionary fuzzy-based approach. Journal of Manufacturing Technology Management, 15(8), 723-734.

Ordoobadi, S.M. & Wang, S. (2010). A multiple perspectives approach to supplier selection. Industrial Management & Data, 111(4), 629-648.

Percin, S. (2006). An application of the integrated AHP-PGP model in supplier selection. Measuring Business Excellence, 10(4), 34-49.

Saaty, T.L. (1980). The Analytical Hierarchy Process: Planning, Priority Setting, Resource Allocation, McGraw-Hill, New York, NY.